SBA Loan, PPP Loan and Taxes

Taxes – nobody likes paying them but we all have to deal with them. Whether you’re a business owner or employee, the rules keep changing and the DAB is here to help. Three of our very own members walked us through recent changes in the PPP guidance for businesses as well as some tax planning tips for business owners and individuals.

Our panelists included: Cindy Grove, Cindy Gomerdinger & Dan Giordano. Our moderator was Eric Walters.

Cindy Grove, Senior V.P. Relationship Manager

PPP ROUND 2 QUICK OVERVIEW

The first round of the SBA and PPP Loans was a source of much confusion but the second round has a lot more clarity. Those who missed getting $$ in Round One they are likely to get loans in round Two.

The $284 Billion funding of Round 2 PPP has the following requirements:

- You have no more the 300 employees

- You can demonstrate a 25% loss in gross receipts in a quarter of 2020 over to the same quarter

- You have used the full amount of your PPP loan in round 1 in 2019.

How round 2 is calculated, you can just re-apply for Round 1 calculations or re-calculate the 2.5x average monthly payroll costs. Businesses with a NAICS code (north American industry classification system you can find on your tax return) Starting with 7’s includes arts, entertainment recreation accommodations and food services may use 3.5x. There is a 5 year repay @1% rate.

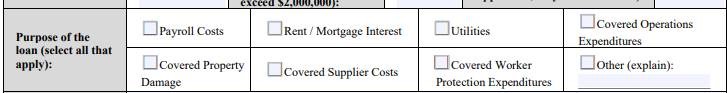

The EIDL Grant funds are now “not excluded” from forgiveness and reconciliations / refunds being processed. Round 2 has expanded categories the funds can be used for the following:

Cindy Gomerdinger, Owner

Is the PPP forgiveness taxable? No, from the beginning the intention was that the forgiveness of debt from the PPP would not be taxable. However, the IRS later pointed out that expenses associated with tax exempt income are not deductible. Therefore, the impact on the taxable income would have been the same as if the debt forgiveness was taxable. On 12/27 they fixed this in the 2nd stimulus package and now the original PPP loans and the 2nd Draw PPP loans will not be considered income AND the expenses associated with the forgiveness are deductible.

Is the EIDL Advance taxable? No, it is not taxable and it will be fully forgiven. They fixed this in the 2nd stimulus package as well. For those that applied for forgiveness last year, the $10K advance was excluded from the forgiveness and you either continued to owe it back through a loan or you repaid it. Due to the 2nd stimulus package fixing this error, any amounts repaid on the advance will be paid by the SBA to the bank and the bank will send you a reimbursement.

What happens if you received a stimulus payment (individually), but your 2020 income is too high to qualify for it? You will not have to return the excess stimulus via the filing of your 2020 return. It is “yours” even if your income was too high in 2020. If you did NOT get a stimulus payment and your 2020 tax return reflects income lower than the thresholds of $150K for joint filers and $75K for single, you will be able to get the stimulus through a “credit” on your 2020 tax return.

Are W2 wages taxable if paid for through the PPP funds? Yes, they are taxable to the employee regardless as to whether the payroll was funded with PPP $’s.

Dan Giordano, Founding Partner and Principal

Some employers might qualify for Employee Retention Credits (ERC). The opportunity to qualify for these credits is simplified now when compared to when they were first legislated in March of 2020. Previously, employers who selected Paycheck Protection Program (PPP) loans weren’t eligible for ERCs, but now, the same employer might qualify for both. One important consideration is wages used for PPP forgiveness cannot be considered and part of calculations for ERCs. Said different, wages cannot be duplicated for these purposes. Therefore careful consideration should be given to wages utilized in PPP loan forgiveness applications and wages utilized for ERC calculations. Consultation with a businesses’ payroll service provider is relevant because ERCs affect current payroll tax filing forms and there is potentially an opportunity to go back to 2020 to recognize ERCs which might be refundable to the business. IRS guidance continues to be issued with respect to these benefits.

Aside from PPP loans and ERC’s, opportunity may exist for certain employers and self-employed individuals to gain benefit from Paid Sick Leave and Family Leave credits. Again, consulting with your team of professionals to optimize your opportunities is prudent. As it concerns the question about breakeven for employer tax credits for these benefits, in GENERAL terms (specifics must be analyzed on a case by case basis), benefits might be assessed in the following order or priority, versus a breakeven analysis:

- PPP loans; then determine best utilization of wages and expenses when going through the forgiveness process.

- ERCs; remainder of wages after the PPP forgiveness process.

- Leave credits.

Items 2 and 3 above depend on employer size (number of employees) and payroll service provider’s ability to get everything computed. IRS forms and instructions are just emerging (leave credits form and instructions were just issued 01.28.21).

A big thank you to Cynthia Wellbrock who is the author of this article.